lakewood sales tax rate

The average sales tax rate in Colorado is 6078. 6 rows The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales.

Business Licensing Tax City Of Lakewood

The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax.

. The California sales tax rate is currently. The Lakewood sales tax rate is. Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3.

4 rows Lakewood CA Sales Tax Rate The current total local sales tax rate in Lakewood CA is. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and.

What is the sales tax rate in Lakewood California. Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements. A Public Improvement Fee PIF is a fee that developers may require their tenants to collect on sales transactions to pay for on-site improvements.

The Lakewood New Jersey sales tax is 700 consisting of 700 New Jersey state sales tax and 000 Lakewood local sales taxesThe local sales tax consists of. The current total local sales tax rate in Lakewood NJ is 6625. There is no applicable city tax or special tax.

The Lakewood Sales Tax is collected by the merchant on all qualifying sales made within Lakewood. The County sales tax rate is. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

A fee of 15 is required to obtain a sales tax license. The Belmar Business areas tax rate is 1. The County sales tax rate is.

There is no applicable city tax or special tax. This is the total of state county and city sales tax rates. Therefore it becomes a part of the overall cost of the saleservice and is subject to sales tax.

The city of Lakewood has a tax rate of one and one-half percent 15 but allows a credit of up to one-half of one percent 05 for a tax withheld for other localities by the employer. For tax rates in other cities see Ohio sales taxes by city and county. State of Colorado 29 Jefferson County 05 RTD 10 Cultural 01 11 City of Lakewood.

This is the total of state county and city sales tax rates. The 10 sales tax rate in Lakewood consists of 65 Washington state sales tax and 35 Lakewood tax. The Lakewood Municipal Income Tax Division Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107 Phone.

In order to initiate a central register of tax ordinances of municipalities that administer local. The Colorado sales tax rate is currently. The minimum combined 2022 sales tax rate for Lakewood California is.

This is the total of state county and city sales tax rates. Lakewood in Washington has a tax rate of 99 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Lakewood totaling 34. The PIF is not a City tax but rather a fee the.

This is the total of state county and city sales tax rates. Did South Dakota v. LAKEWOOD COMBINED SALES TAX RATE.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Illinois sales tax rate is currently. The PIF is a fee and NOT a tax.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The minimum combined 2022 sales tax rate for Village Of Lakewood Illinois is. For most of Lakewood the combined sales tax rate is 75.

State of Colorado 29 Jefferson County 05 RTD 10 Cultural 01 11 City of Lakewood 30 Total Combined Rate 75 In Belmar the combined sales tax rate is 55. City of Lakewood Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107. This chapter 301 shall be known as the City of Lakewood Sales and Use Tax Code and may be cited herein as this Tax Code 301120 Notice of Sales and Use Tax Ordinance Amendment A.

Method to calculate Lakewood sales tax in 2021. You can print a 8 sales tax table here. Groceries and clothing are exempt from the Lakewood and New Jersey state sales taxes.

Lakewood collects the maximum legal local sales tax. The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025. What is the sales tax rate in Village Of Lakewood Illinois.

The December 2020 total. The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales tax. The Village Of Lakewood sales tax rate is.

There is no applicable county tax or special. The County sales tax rate is. The Lakewood sales tax rate is.

Examples of these improvements include curbs and sidewalks parking.

Washington Sales Tax Guide For Businesses

Ohio Sales Tax Guide For Businesses

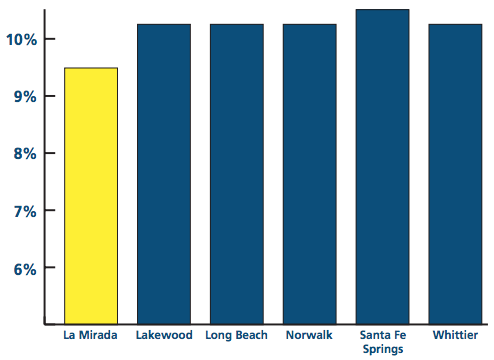

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Other Lakewood Taxes City Of Lakewood

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

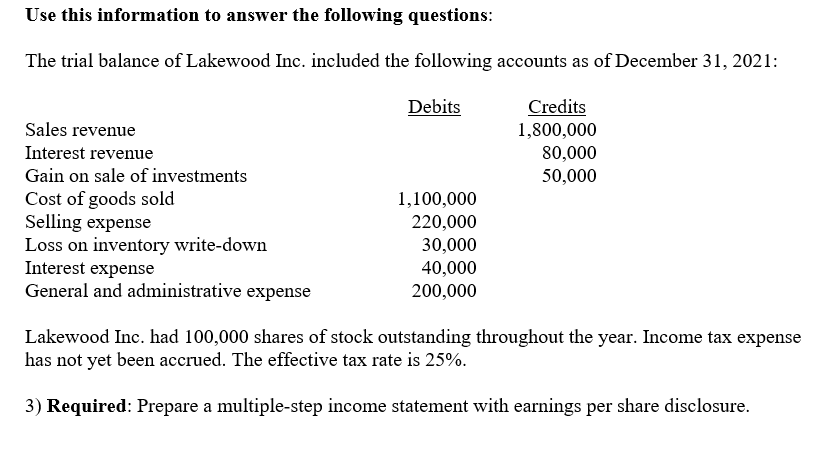

Solved The Trial Balance Of Lakewood Inc Included The Chegg Com

Solved Use This Information To Answer The Following Chegg Com

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Why Do U S Sales Tax Rates Vary So Much

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller

California Sales Tax Rates By City County 2022

Other Lakewood Taxes City Of Lakewood

Sales Use Tax City Of Lakewood